22+ Partial claim mortgage

FOR RELEASE Monday April 18 2022. For homeowners who can resume making their existing monthly mortgage payments FHA has established a revised COVID-19 Recovery Standalone Partial Claim.

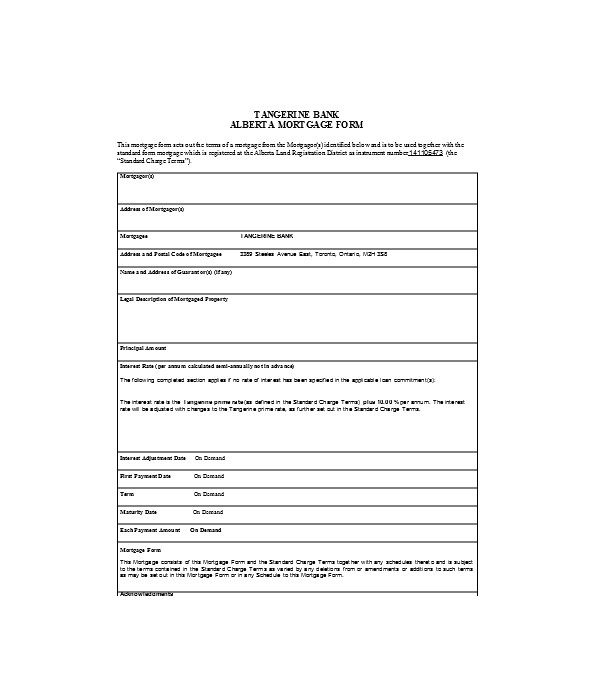

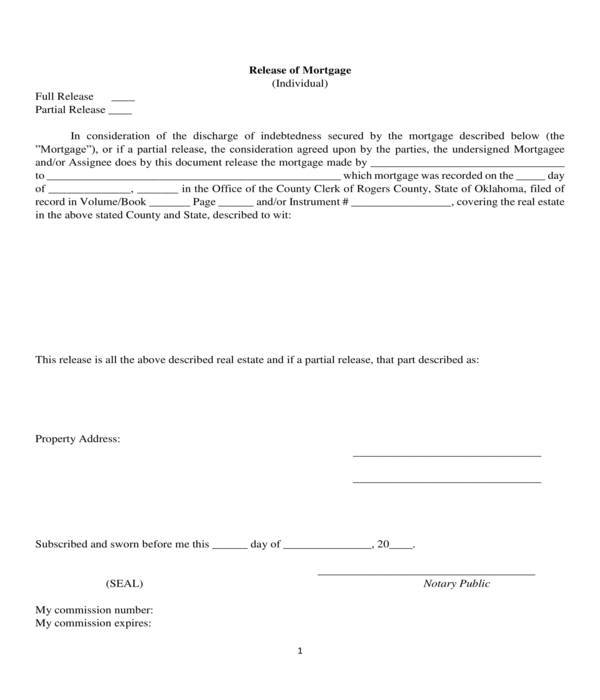

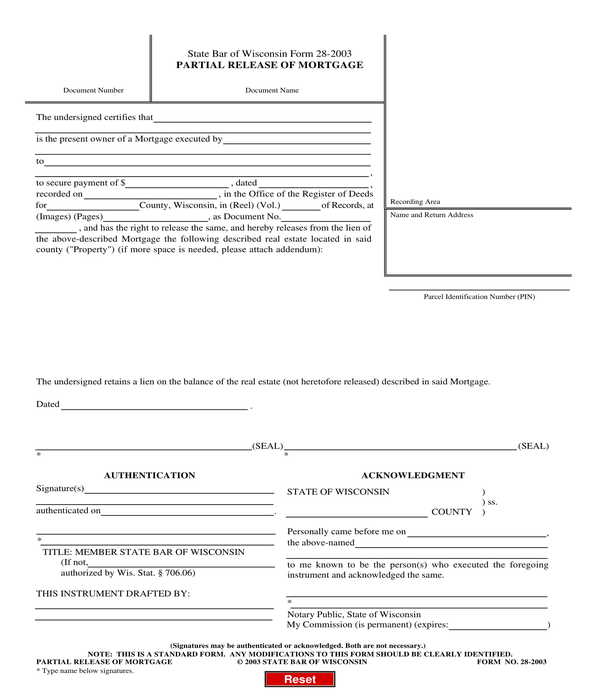

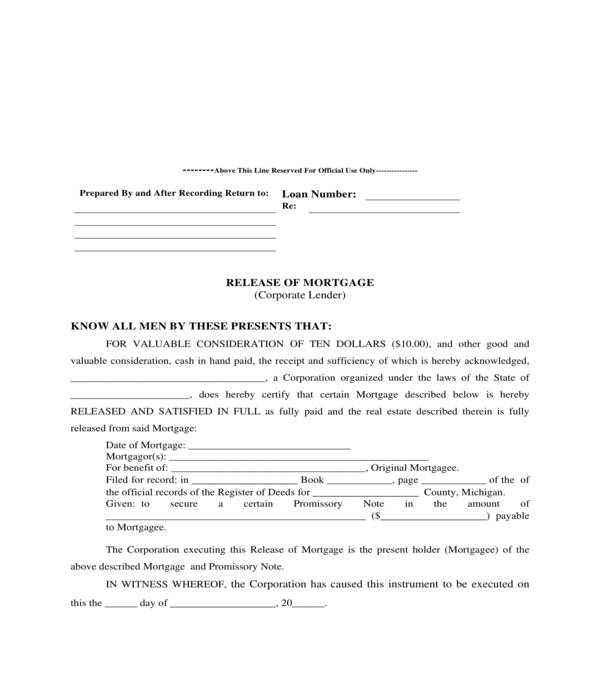

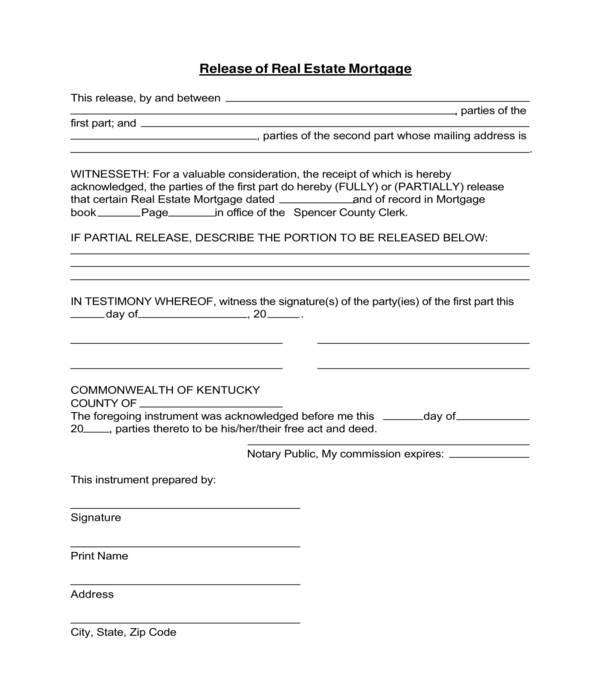

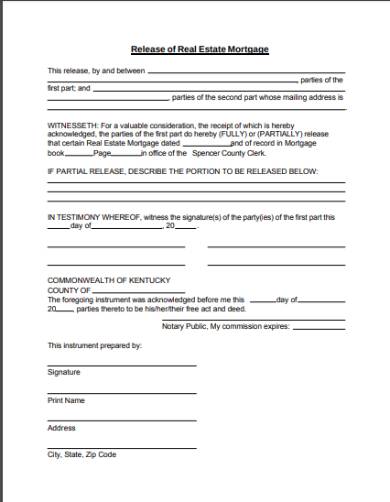

Free 6 Mortgage Release Forms In Pdf Ms Word

Accepting a HUD partial claim payment means that you agree to repay 75 of the loan amount and enter into a 20-year HUD Use Agreement.

. With this process you will be able. If you are unable to pay the partial claim. A partial claim is a non-interest bearing lump sum amount of money that gets recorded against a property as a subordinate lien to the primary mortgage.

The FHA partial claim is a loss mitigation procedure that is offered in conjunction with HUD. If you make all required trial period payments return the necessary agreements timely and continue to meet all requirements you will receive a partial claim mortgage that places an. The Mortgage was current or less than 30 Days past due as of.

In order to qualify for this process you must have an FHA loan. The Mortgagee must ensure the following eligibility requirements are met for a COVID-19 Standalone Partial Claim. FEDERAL HOUSING ADMINISTRATION ADDS 40-YEAR MORTGAGE MODIFICATION WITH.

1 the partial claim maximum limit suggested by the proposed rule is doubled from. In order for HUD to offer a PPC the mortgagee and the Owner must first. The home must also be the borrowers primary.

A partial claim is an interest-free loan from HUD to get caught up on overdue payments on an FHA loan and is usually completed along with a loan modification or. The COVID-19 Recovery Standalone Partial Claim allows mortgage payment arrearages to be placed in a zero interest subordinate lien that is repaid when the mortgage. Partial Claim A promissory note and subordinate mortgage to cover the advance for delinquent mortgage payments is issued in the name of the Secretary of HUD.

Bankruptcy Court of the Southern District of New York recently sanctioned a mortgage servicer for violating a bankruptcy discharge injunction when it required a debtor to sign a. To qualify for a partial claim on an FHA loan borrowers must be between 4 and 12 months behind on their mortgage payments. The Borrower makes monthly payments of principal and interest on the first loan and.

A partial claim is a federally backed interest-free loan from HUD that homeowners can use to make their mortgage current and avoid foreclosure. WASHINGTON - The Federal Housing Administration FHA announced on Monday that it is adding a new 40-year mortgage modification option for mortgage servicers to use in. Claim and recasts the remaining principal balance of the mortgage under terms and conditions determined by HUD.

22-070 HUD Public Affairs 202 708-0685. How does partial claim mortgage work. Significant changes to the final rule in response to public comments include the following.

A modification with a partial Claim is one where the lender breaks the loan into 2 loans.

Free 6 Mortgage Release Forms In Pdf Ms Word

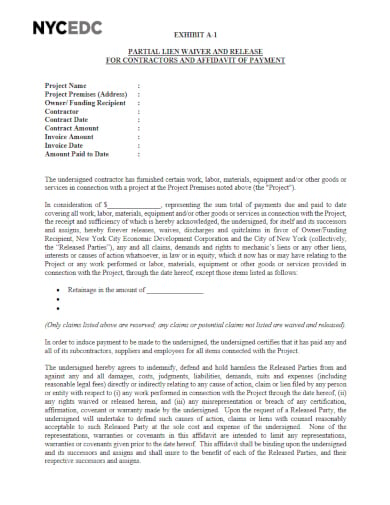

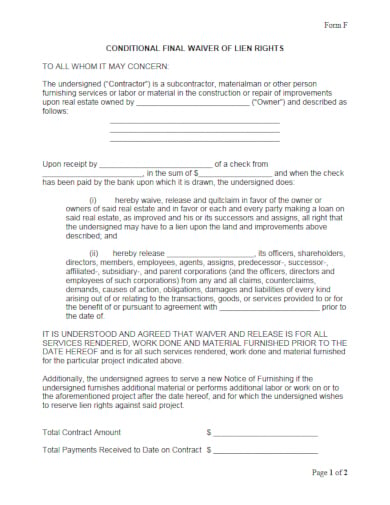

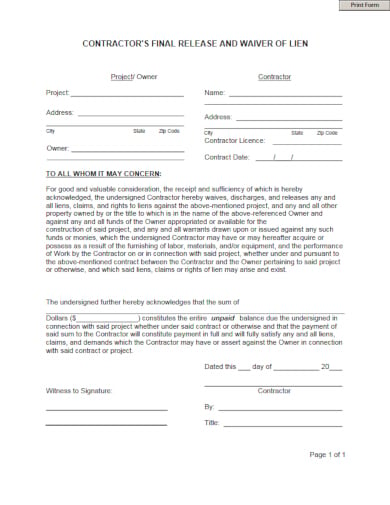

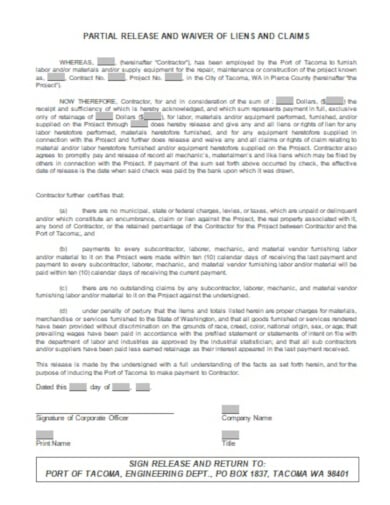

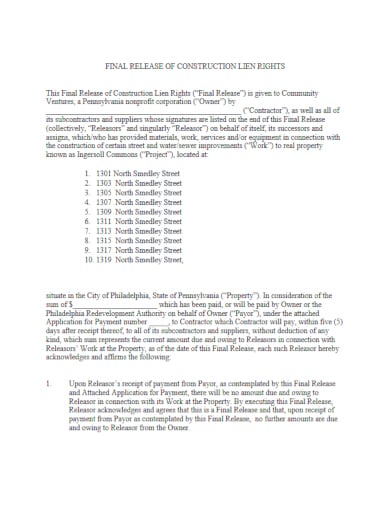

11 Construction Release Form Templates Doc Pdf Free Premium Templates

Free 6 Mortgage Release Forms In Pdf Ms Word

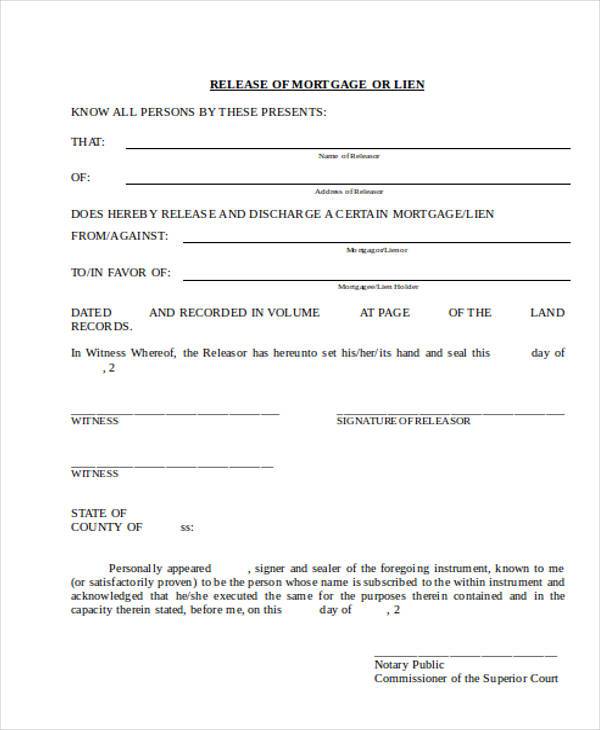

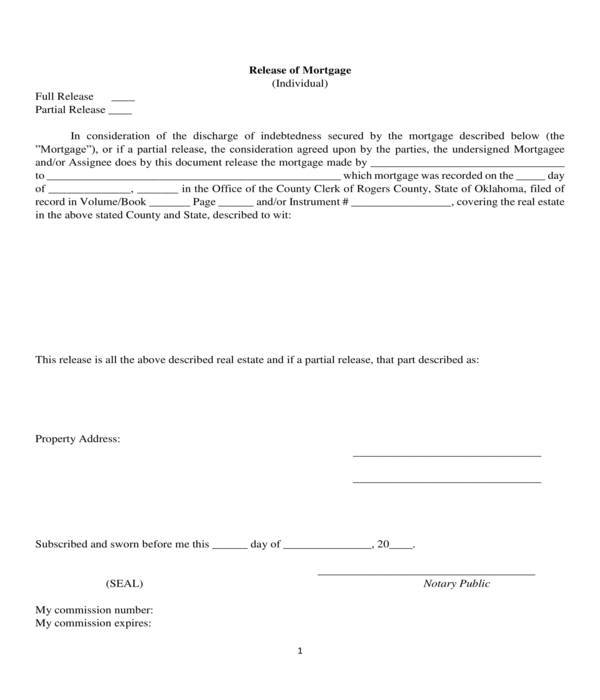

Free 38 Release Forms In Pdf Excel Ms Word

Free 6 Mortgage Release Forms In Pdf Ms Word

11 Construction Release Form Templates Doc Pdf Free Premium Templates

Free 6 Mortgage Release Forms In Pdf Ms Word

11 Construction Release Form Templates Doc Pdf Free Premium Templates

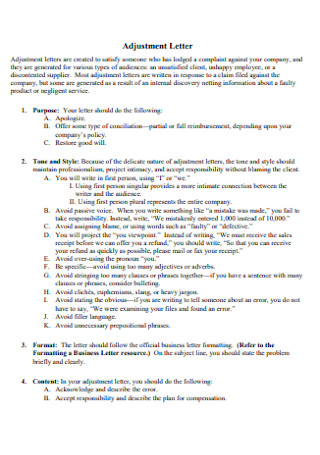

22 Sample Adjustment Letters In Pdf Ms Word

2

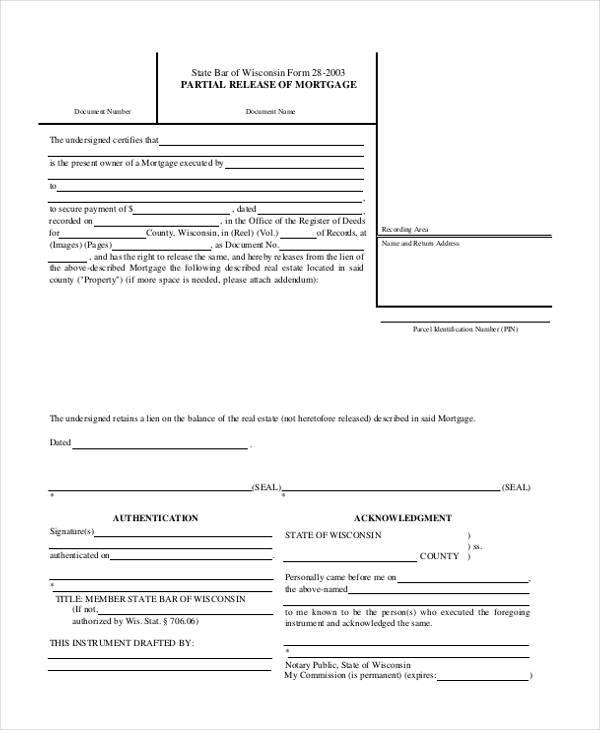

Free 38 Release Forms In Pdf Excel Ms Word

2

2

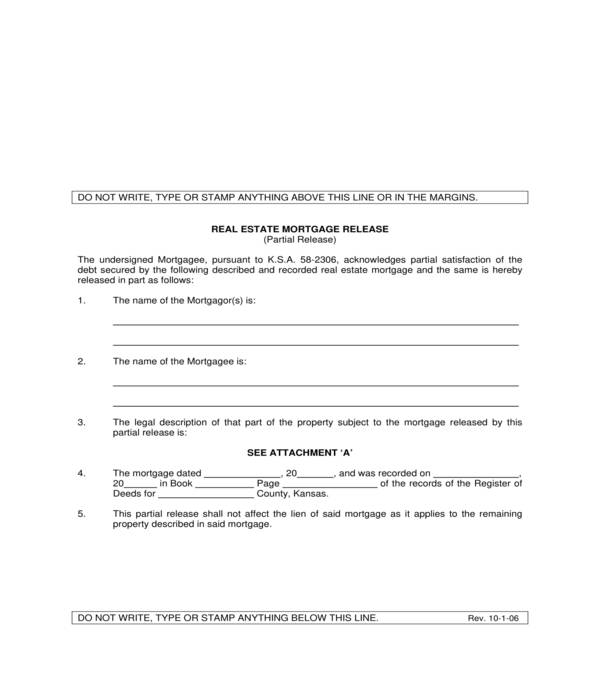

Free 5 Real Estate Lien Release Forms In Pdf

11 Construction Release Form Templates Doc Pdf Free Premium Templates

Free 6 Mortgage Release Forms In Pdf Ms Word

11 Construction Release Form Templates Doc Pdf Free Premium Templates